PROJECT ORBIT

The backdoor listing of Chemist Warehouse Group through a merger with Sigma Healthcare

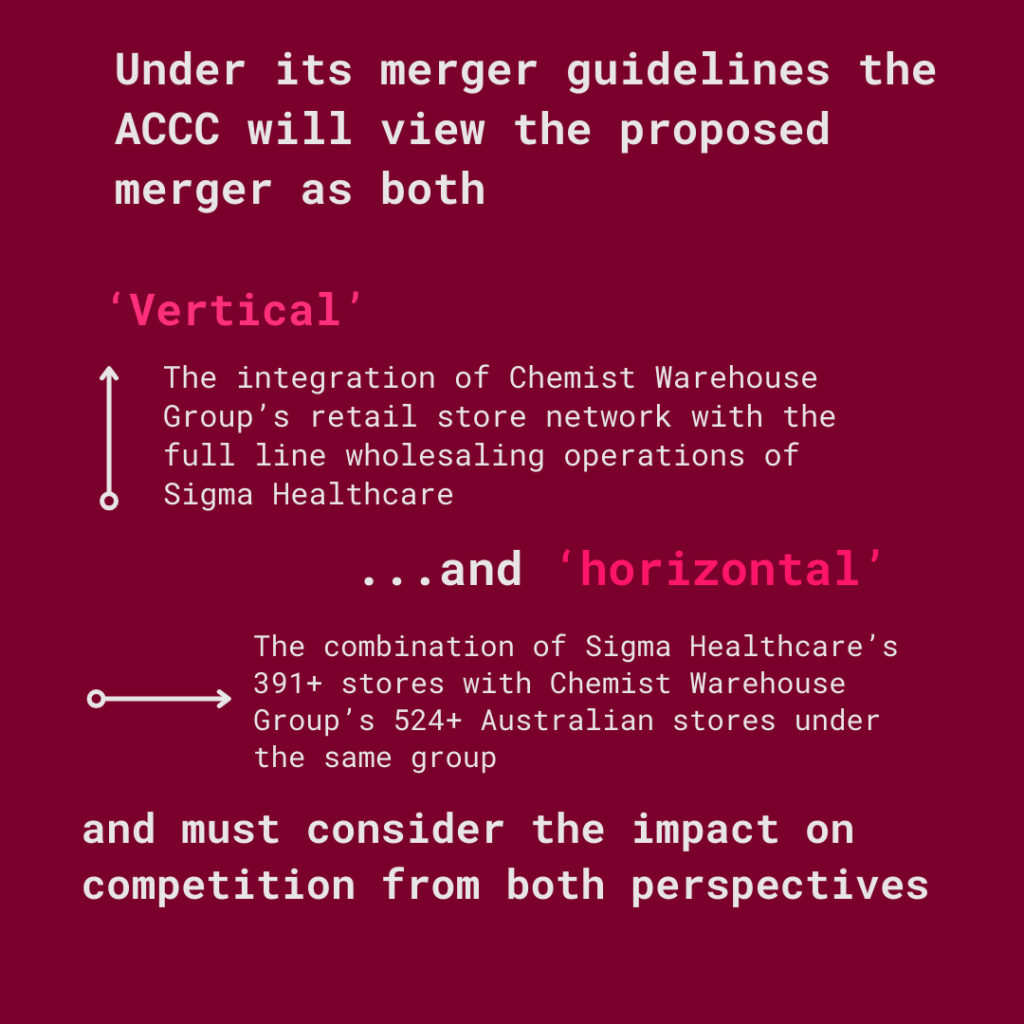

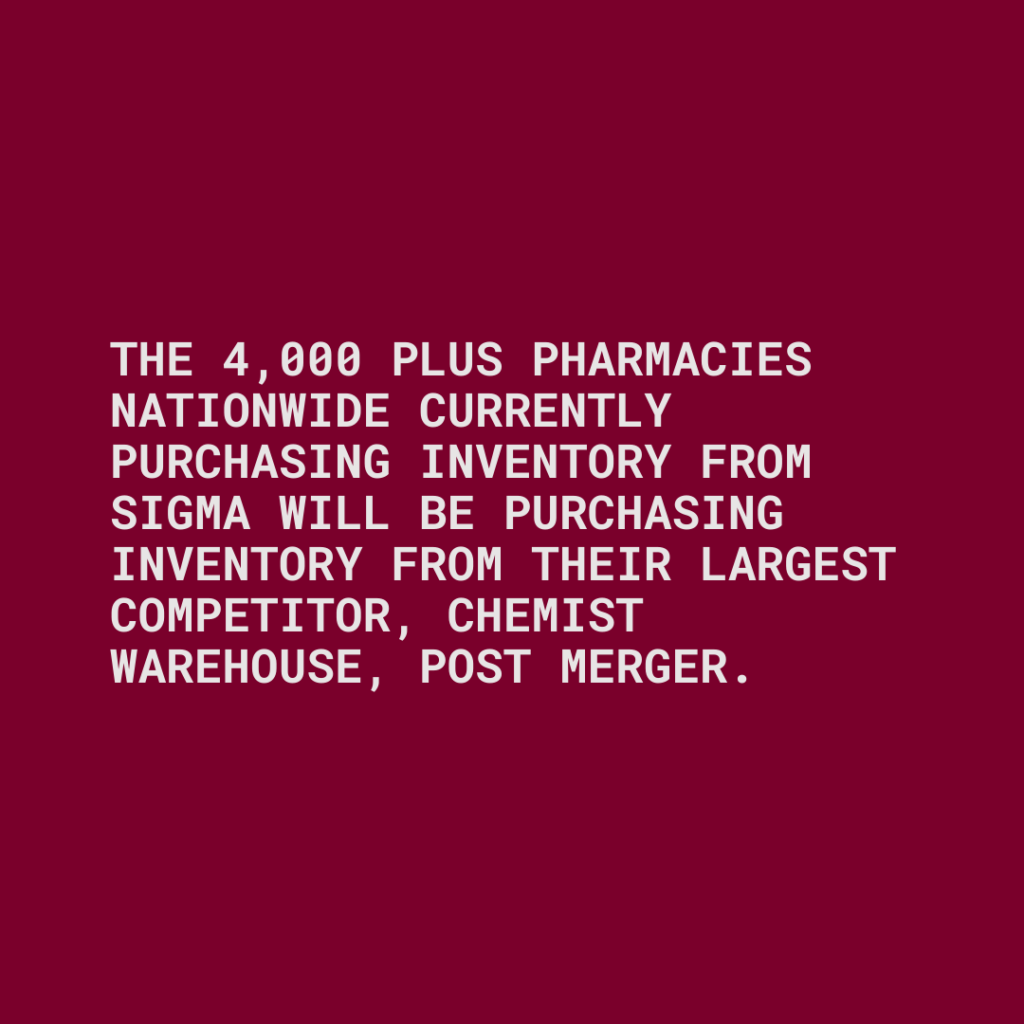

The backdoor listing of Chemist Warehouse Group through a merger with Sigma Healthcare will combine two of Australia’s four largest pharmacy operators and one of its three largest pharmacy wholesalers into a single entity.

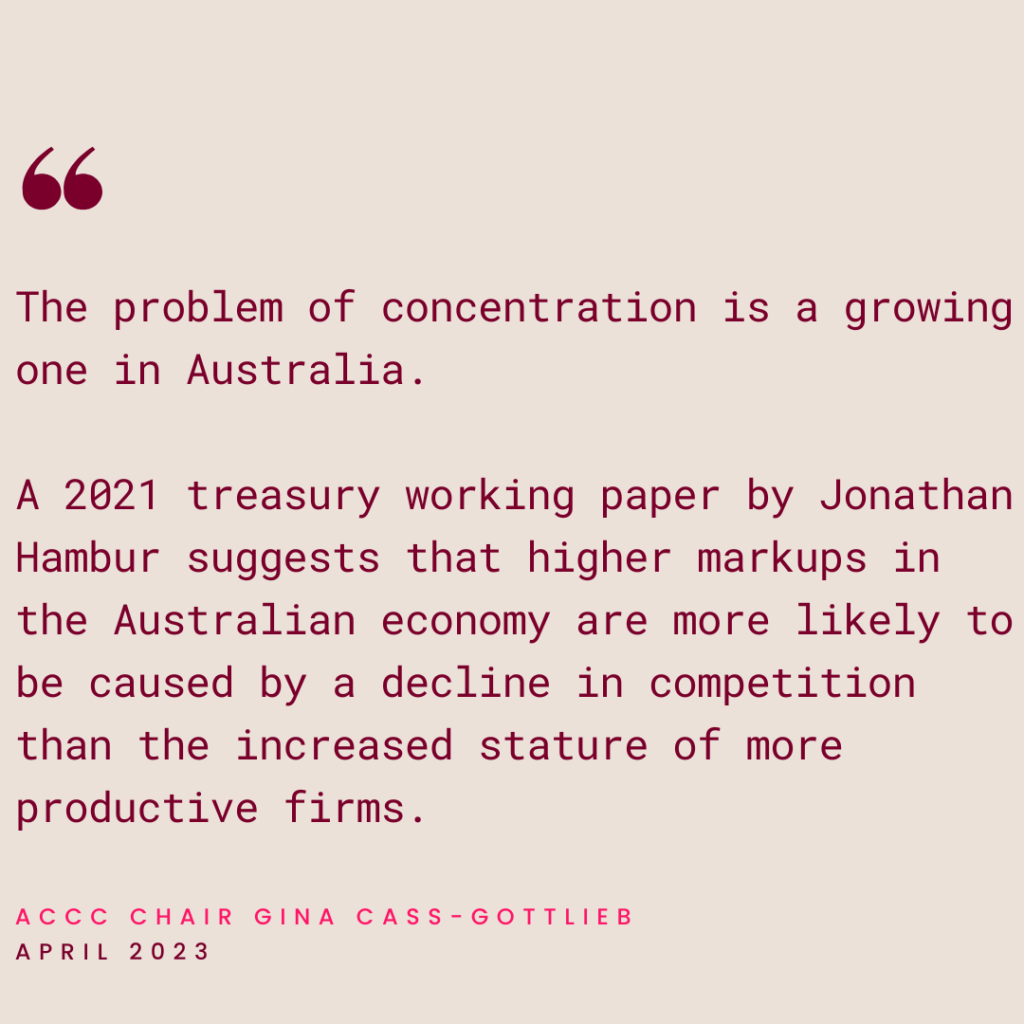

Following a successful merger, the already highly concentrated Australian pharmacy market will resemble the Bunnings-dominated hardware market or the effective duopoly of the supermarkets, rather than the decentralised and diverse ownership structure intended by the spirit of existing legislation.

The purpose of this website is to make it easier to access public data that is difficult to collect and organise. The following analysis shows our view on how the merger, known as Project Orbit, will affect the structure of Australia’s pharmacy market.

Australians are already facing high inflation and rising living costs. They do not need decreased competition in the pharmacy market.

The proposed merger of Chemist Warehouse with Sigma Healthcare would combine two of the four countervailing powers in the Australian pharmacy market. This move is a dangerous and anti-competitive step, mirroring the power dynamics already seen in the grocery sector.

THE ACCC MUST DECIDE IF CONSUMERS ARE BETTER SERVED BY A DECENTRALISED PHARMACY MARKET, AS INTENDED BY THE SPIRIT OF EXISTING LEGISLATION, OR BY BEING DRAWN INTO THE ORBIT OF ANOTHER CORPORATE GIANT.

THE PROVISIONAL DECISION IS DUE ON JUNE 13TH.

AUSTRALIANS ARE RELYING ON THEIR ELECTED REPRESENTATIVES TO ENSURE THE ACCC ACT IN THEIR INTEREST.

The combined company (mergeco)

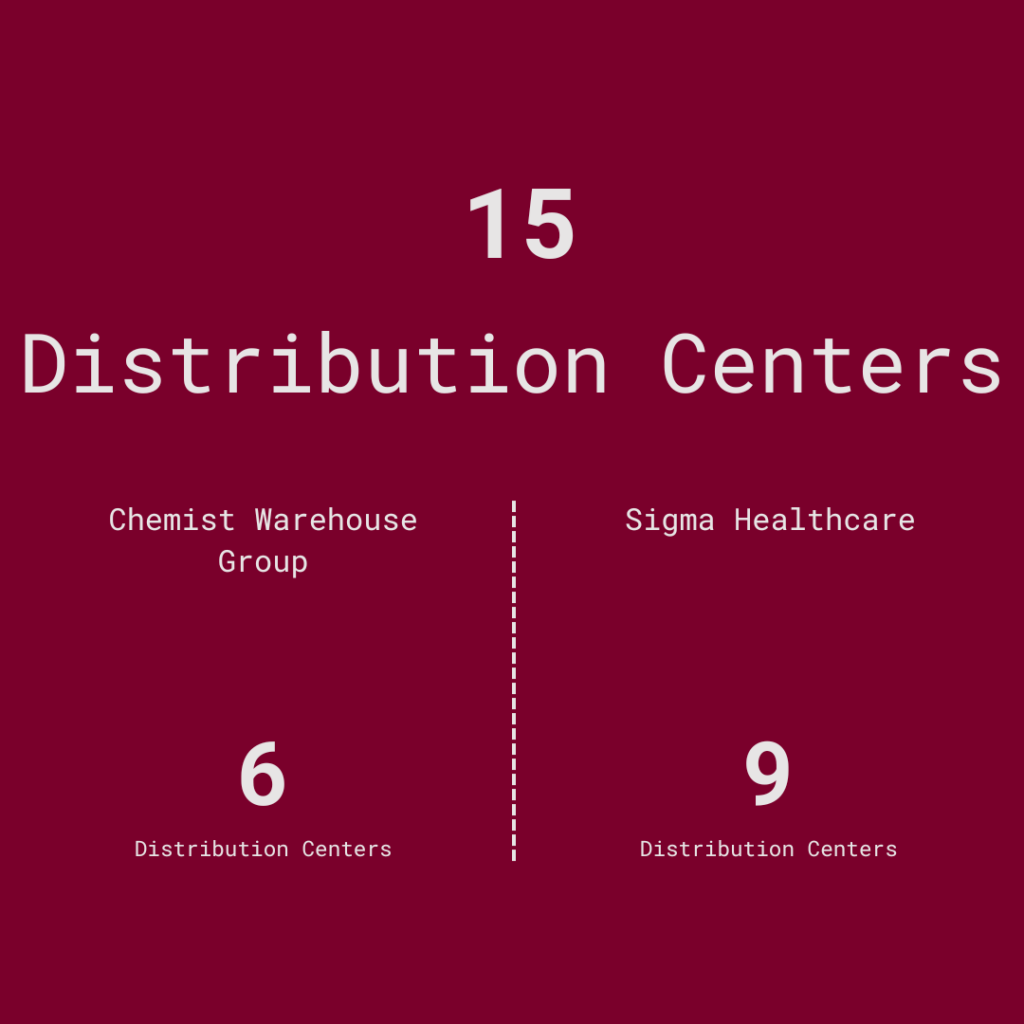

15 Distribution Centers

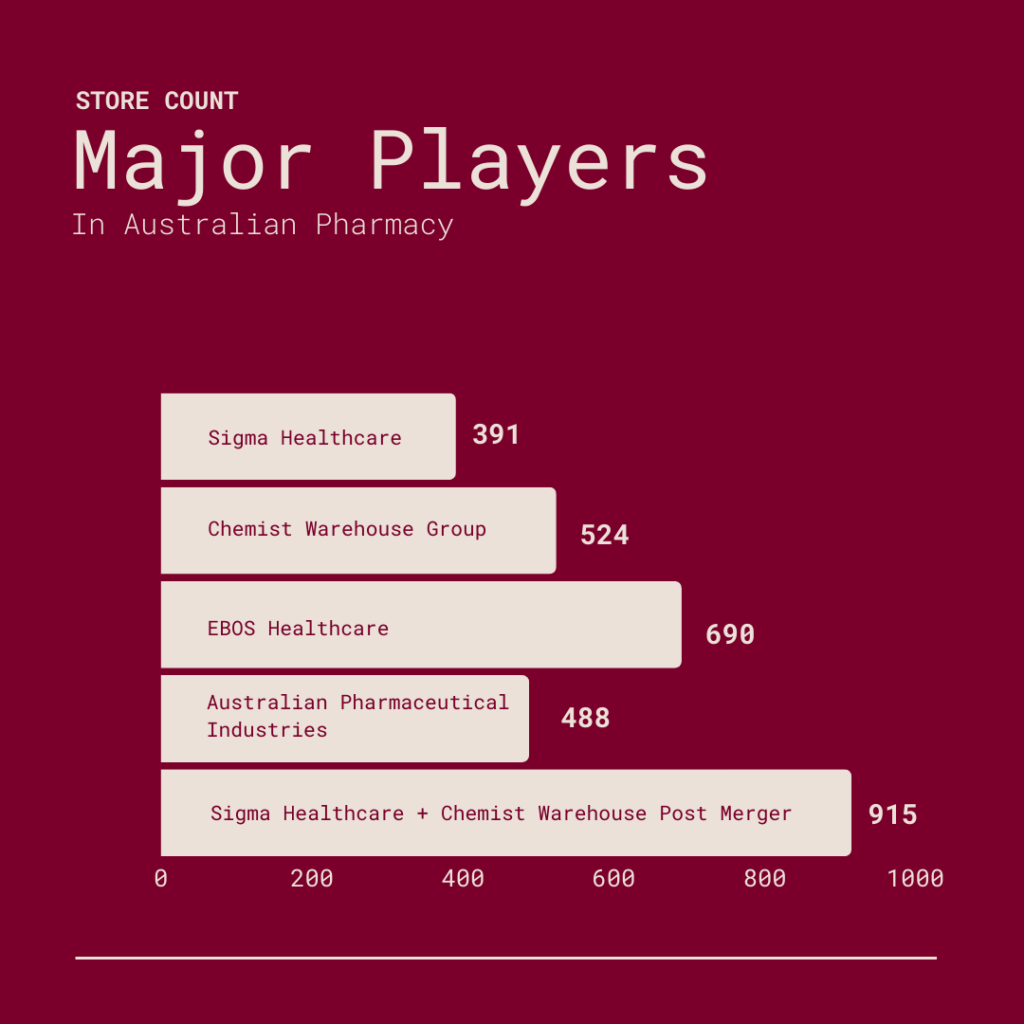

915 stores across Australia

Banner

Store Count

503

21

231

109

43*

51

Originates From

*Guardian pharmacies have been invited to integrate into Amcal. As the integration rate is unclear Guardian stores have not been included in the total store network calculation.

The major players in Australian pharmacies

The data analysis

Wickhams Hill have leveraged CoreList data to compile a comprehensive list of pharmacies across Australia.

This list has been segmented by major banner brands, their corporate owners, and smaller, independent operators. While the CoreList data may be imperfect, Wickhams Hill believe it to be indicative.

The commercial dataset was last updated May 2023.

A custom Python script was developed to map the locations of these pharmacies, overlaying attributes related to their banner brands and corporate affiliations. To further contextualise the data, boundaries from the ASGS Significant Urban Area and OECD Functional Urban Area shapefiles were also integrated into the map, helping to delineate major metropolitan zones. The script executed an analysis to calculate market share based on store count across two distinct market segments: all pharmacies and those associated with major banner brands.

The major banner brands segment highlights the market players with significant influence, while the ‘all pharmacies’ segment encompasses the entire spectrum of pharmacies, grouping minor and independent operators

together under their respective corporate banners.

Be advised that the map files provided in the view are substantial in size and may require some time to load.

If the maps below do not load, you can view them on the streamlit data app, or at the following links:

Pre-merger stores by corporate - Majors only

Post-merger stores by corporate - Majors Only

Pre-merger stores by corporate - All Pharmacies

Post-merger stores by corporate - All Pharmacies

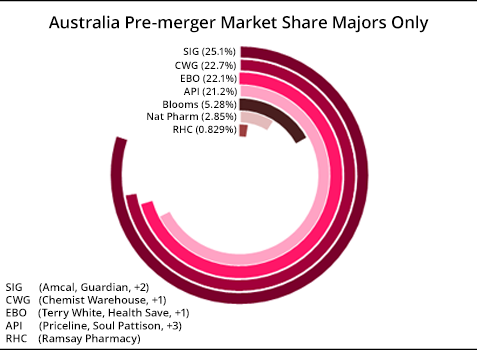

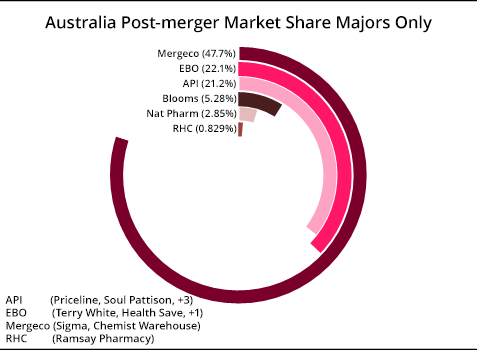

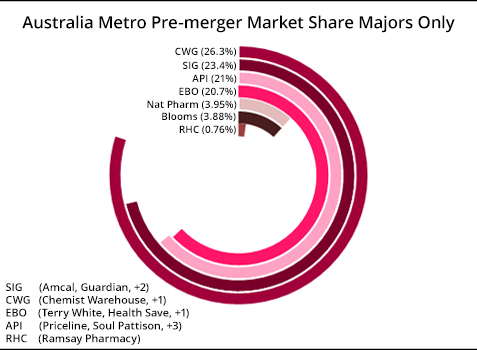

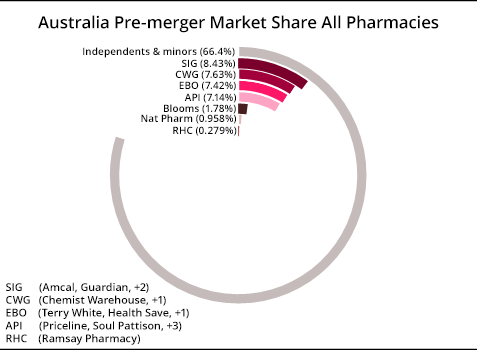

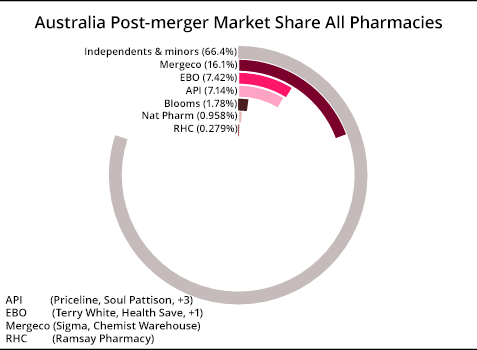

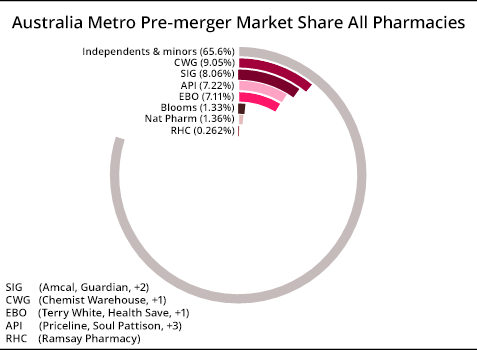

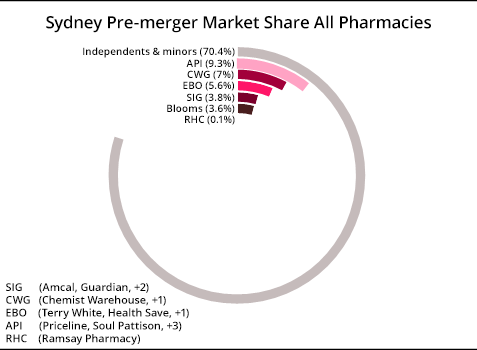

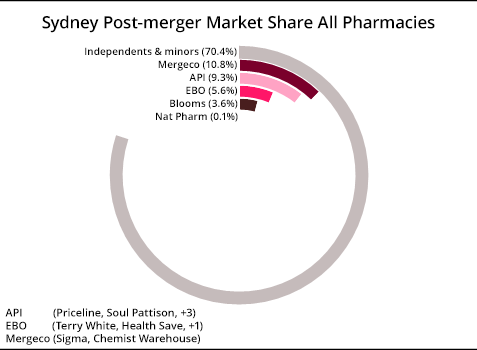

The Market Share Charts

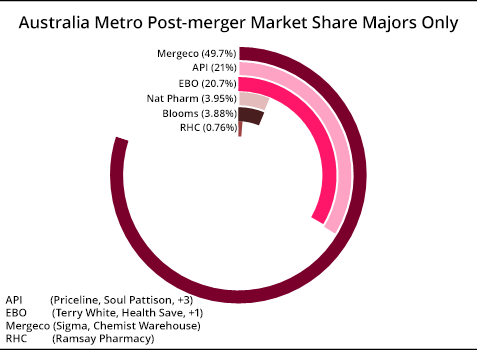

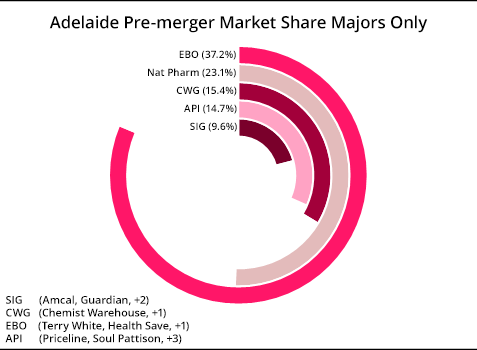

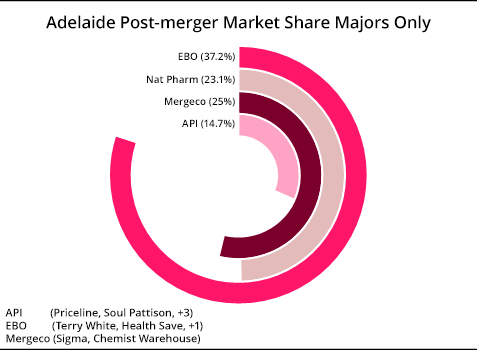

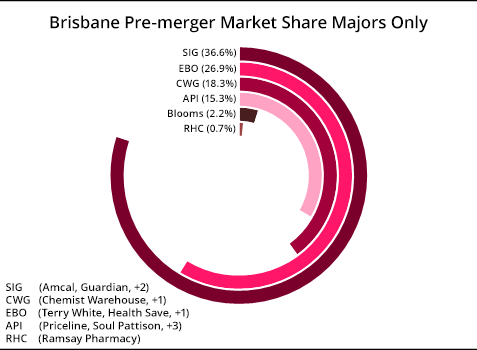

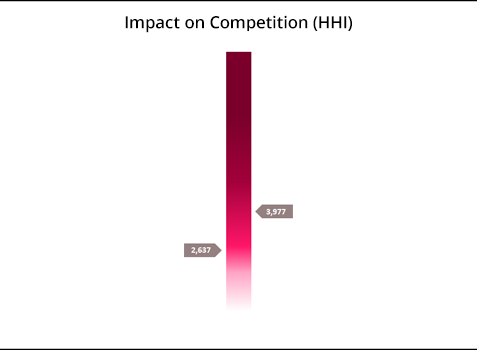

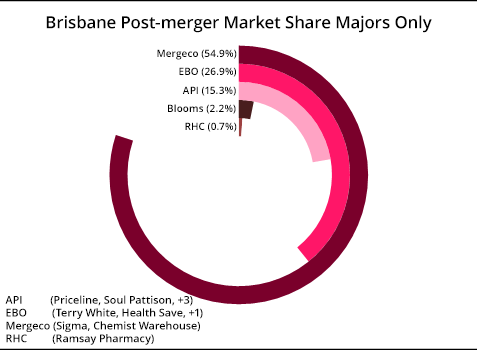

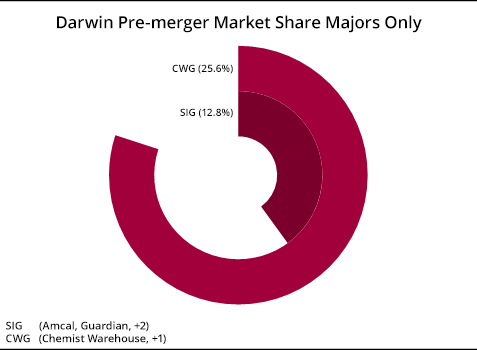

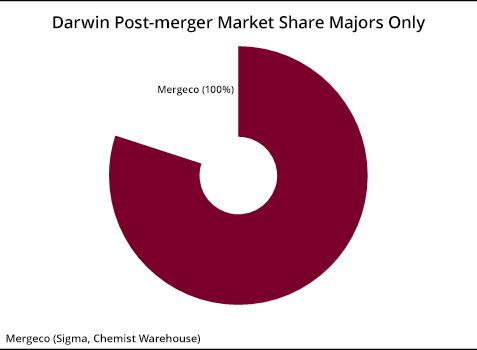

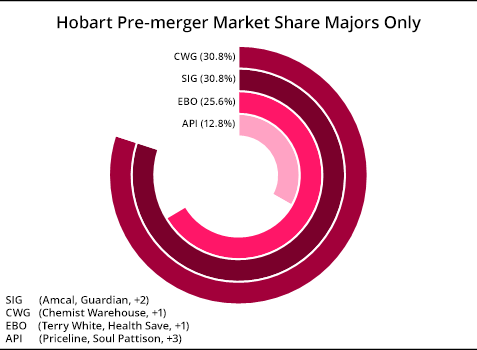

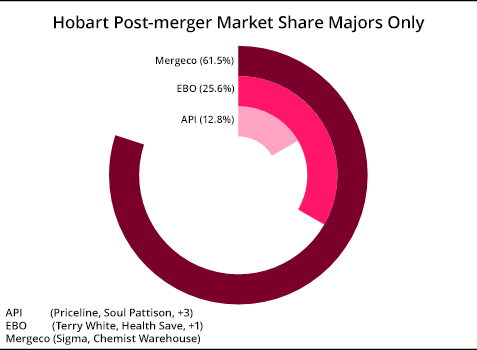

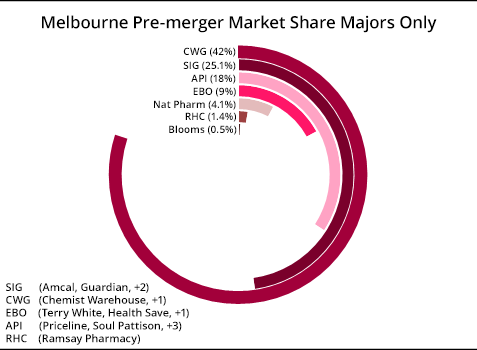

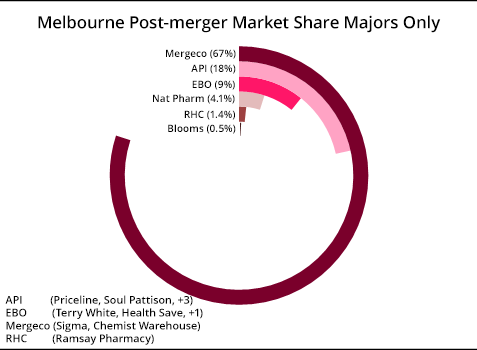

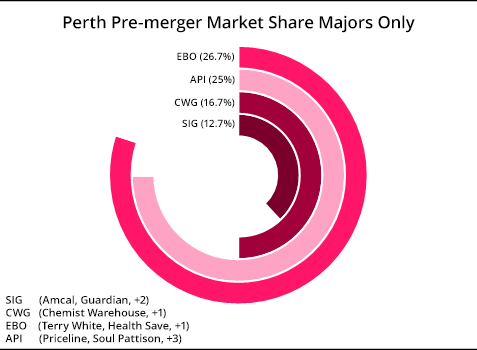

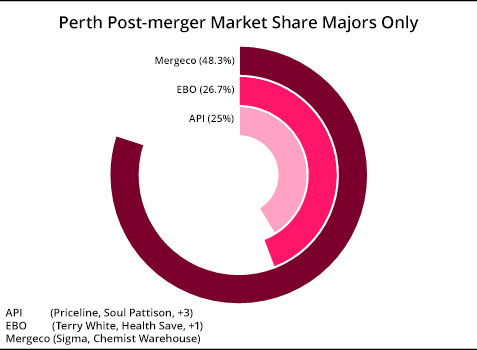

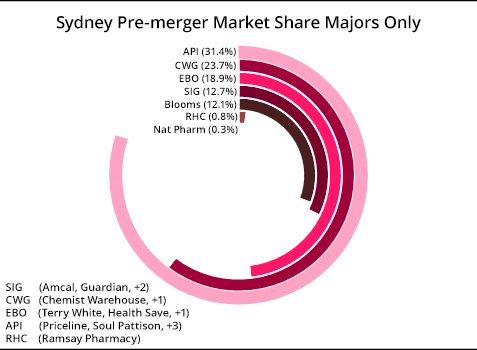

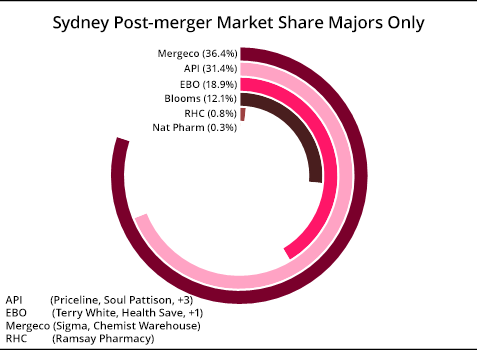

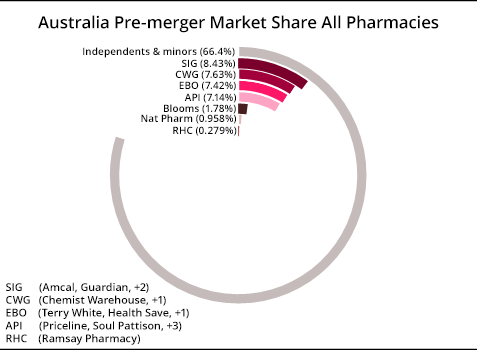

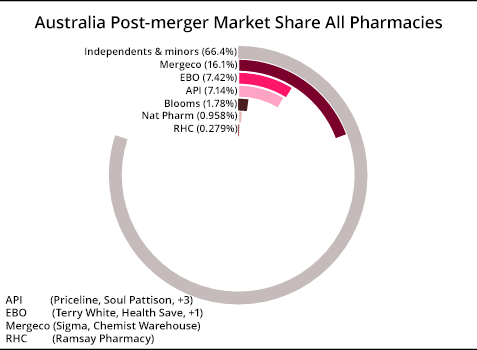

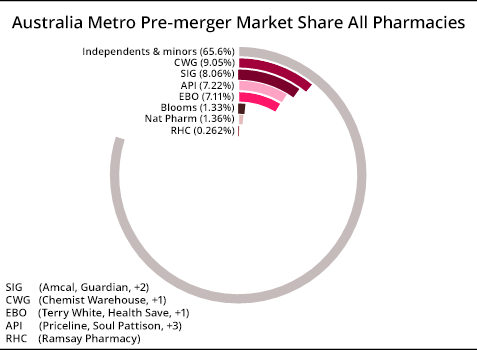

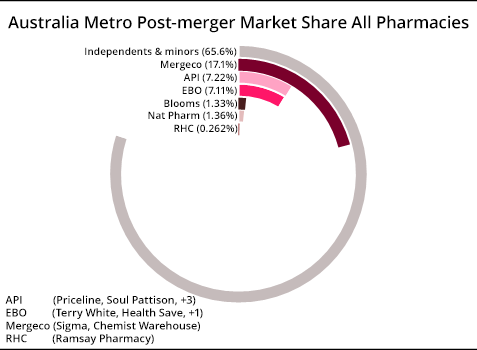

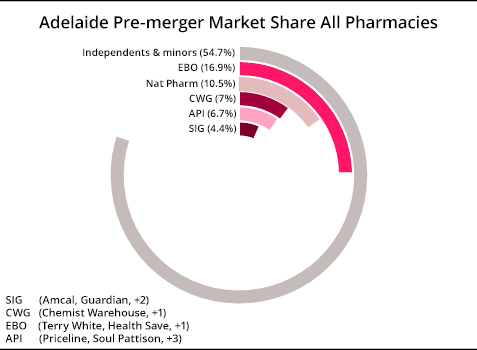

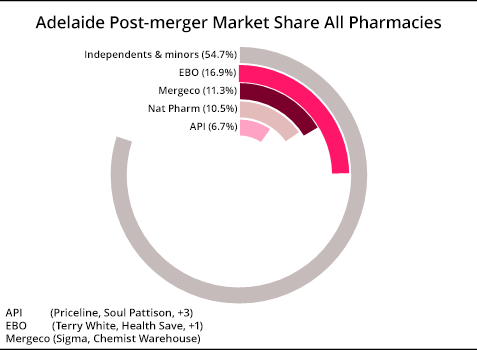

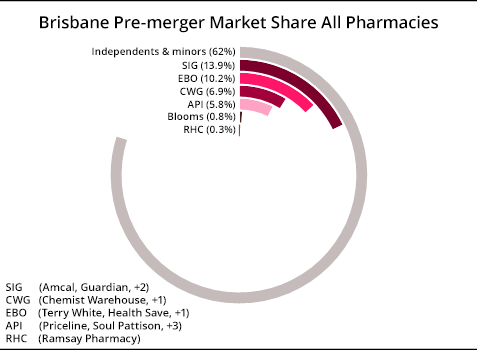

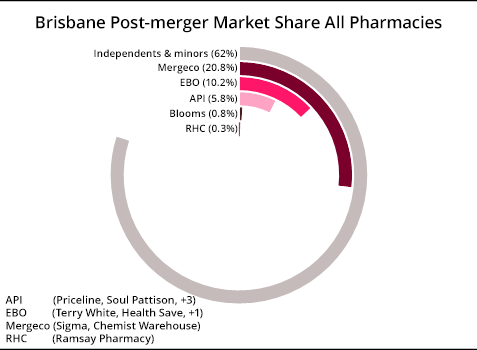

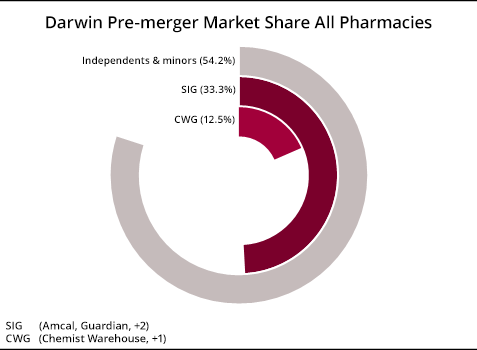

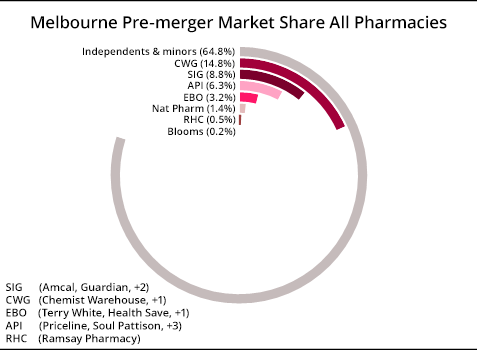

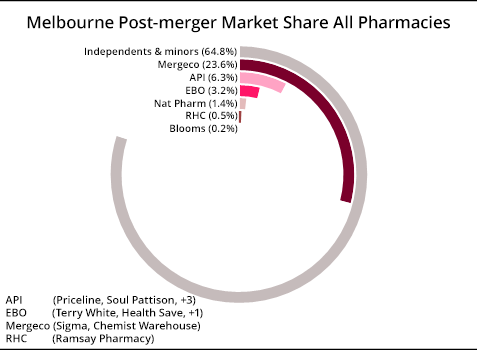

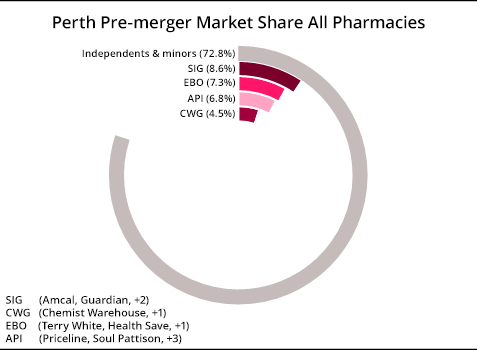

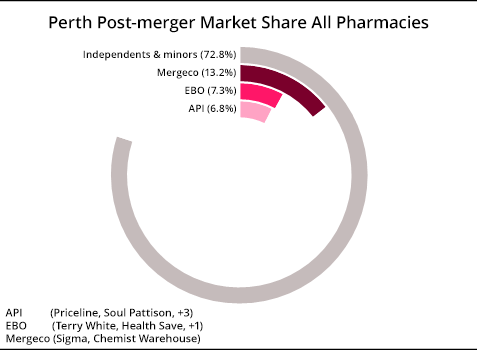

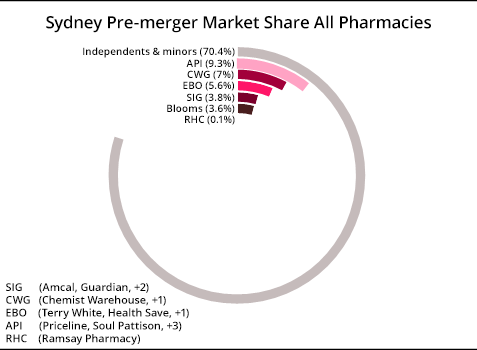

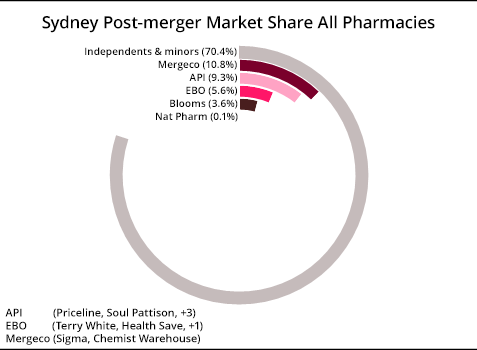

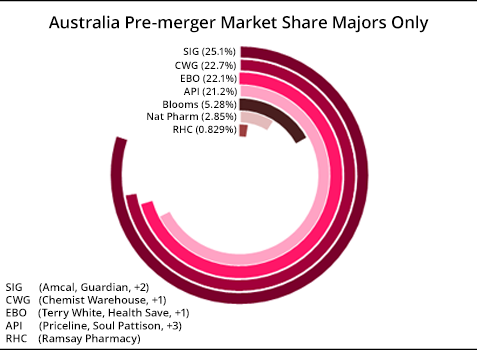

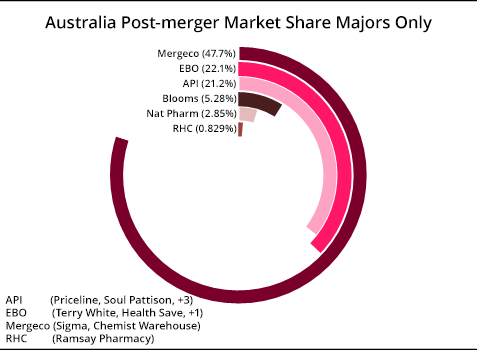

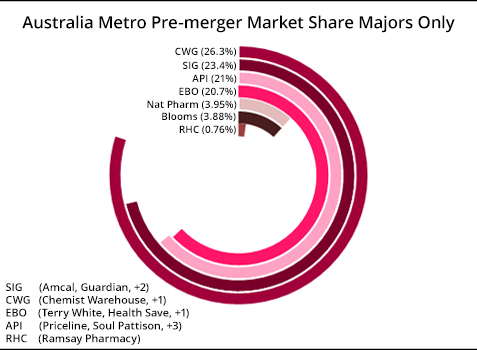

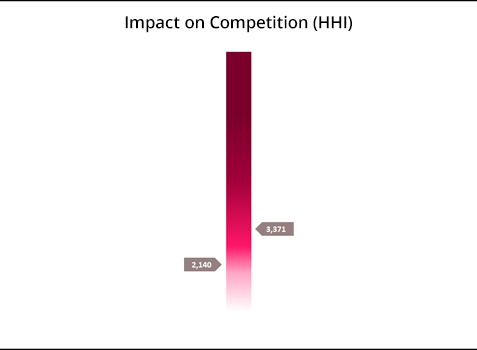

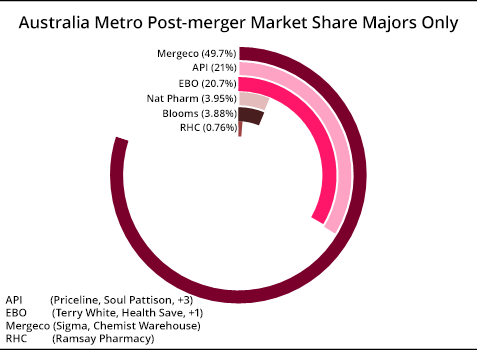

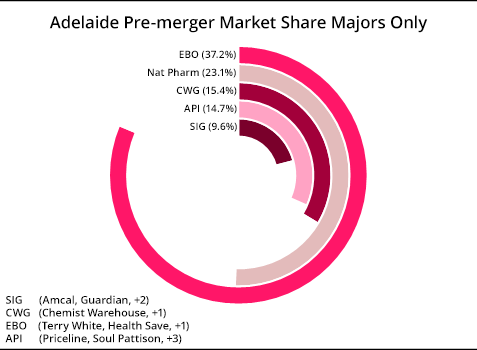

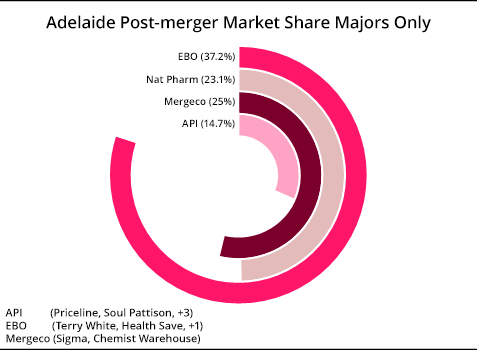

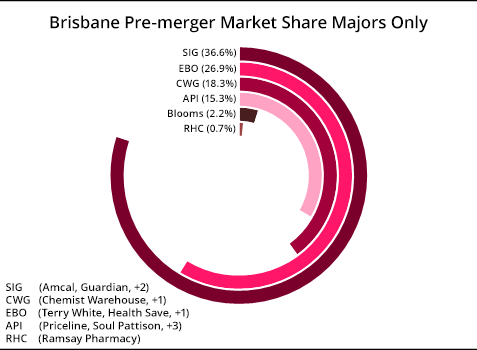

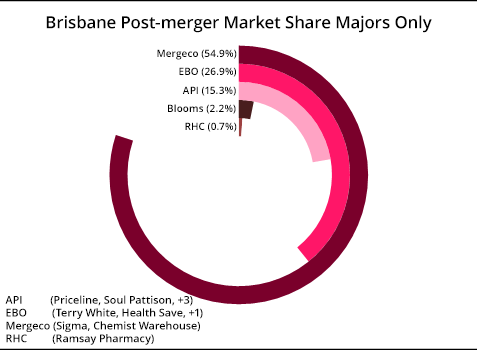

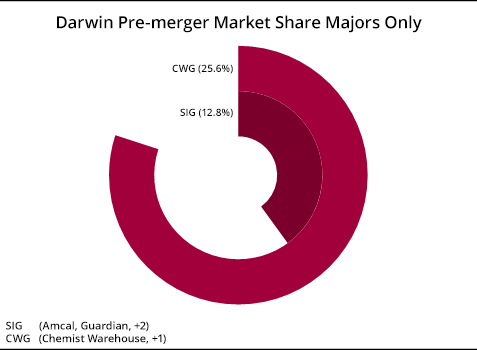

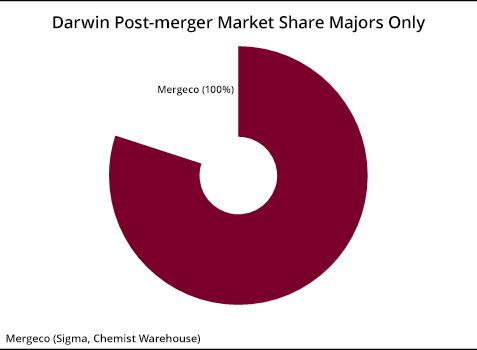

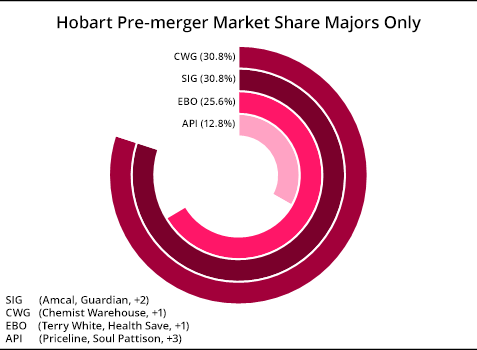

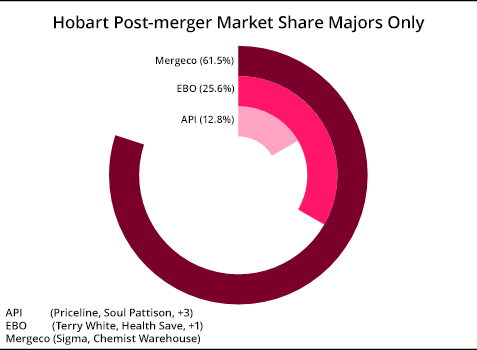

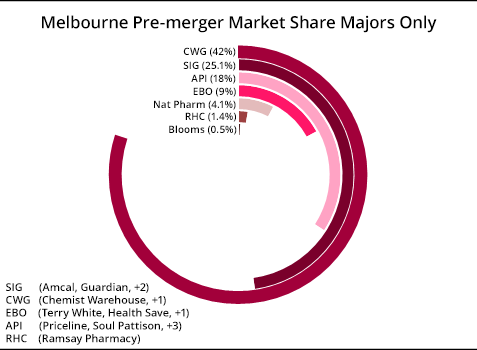

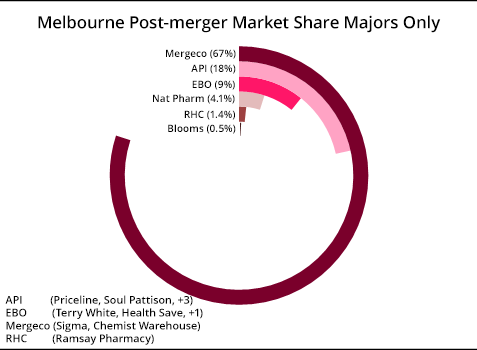

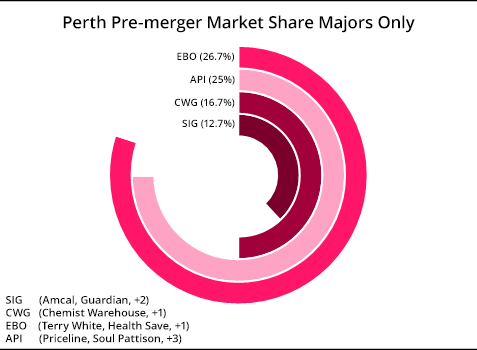

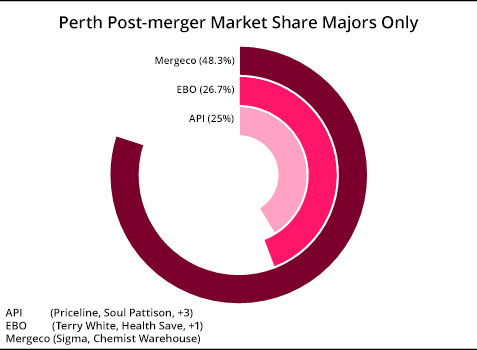

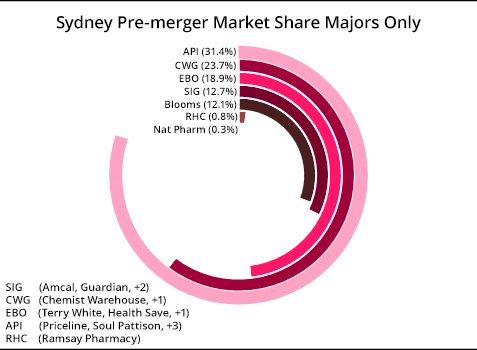

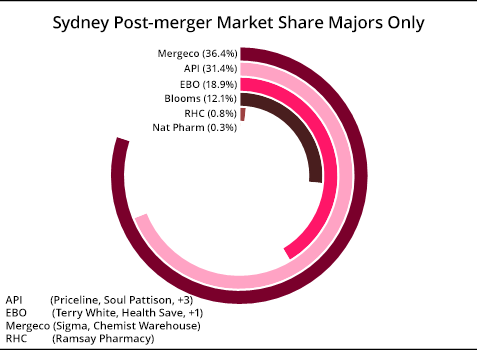

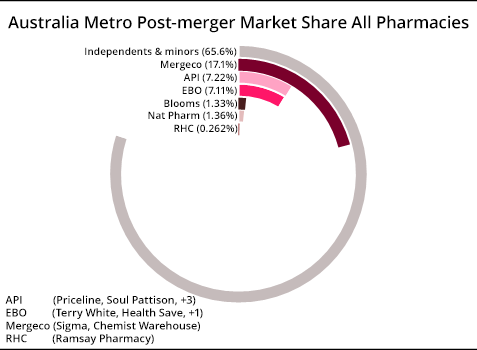

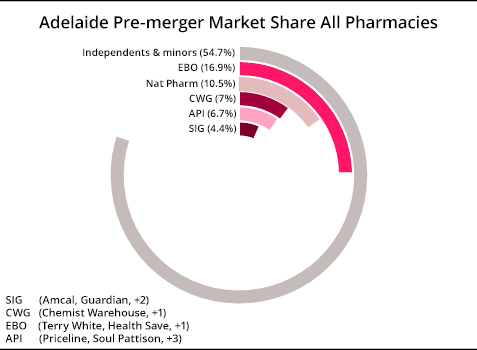

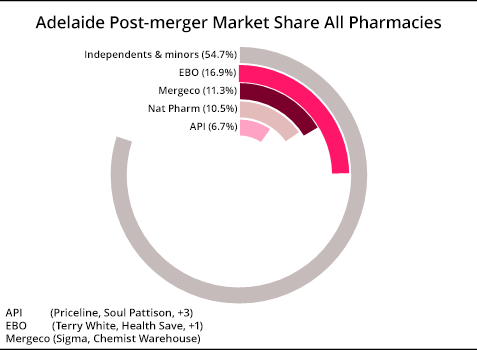

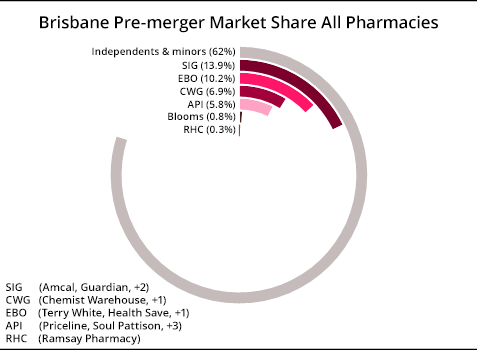

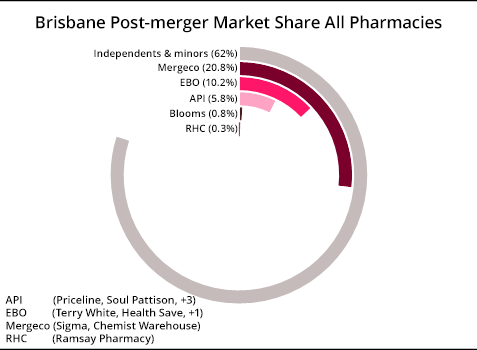

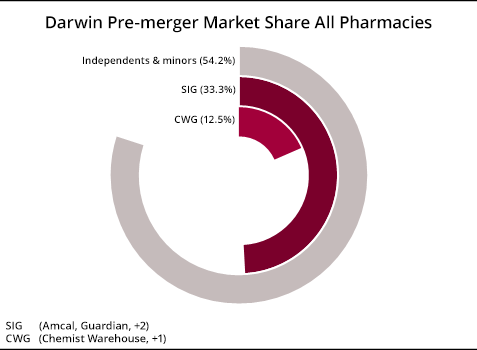

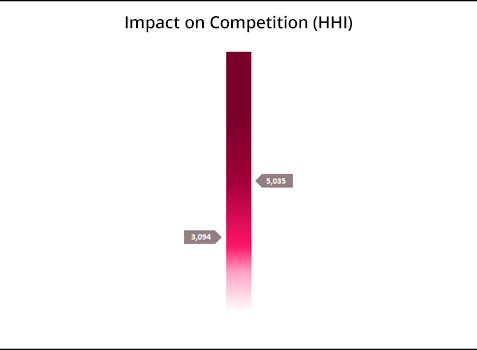

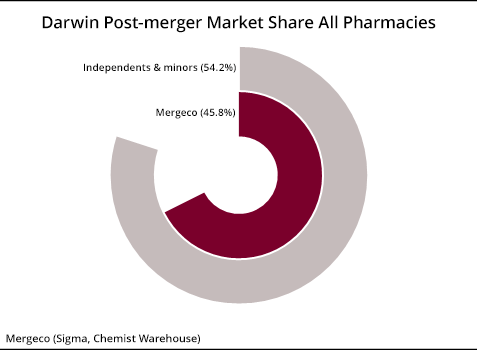

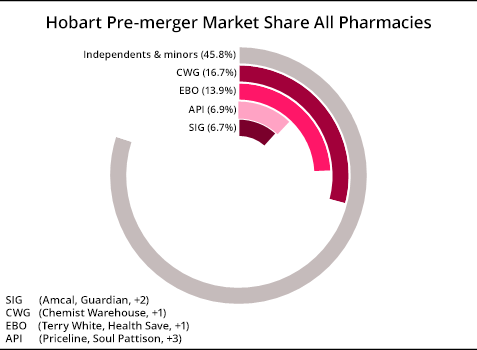

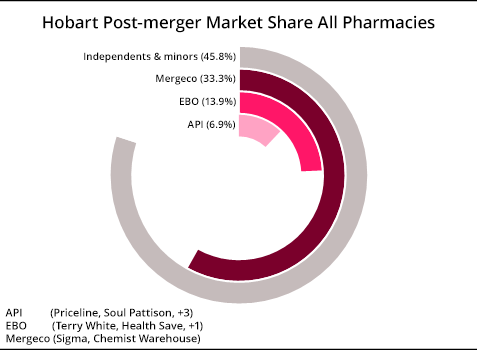

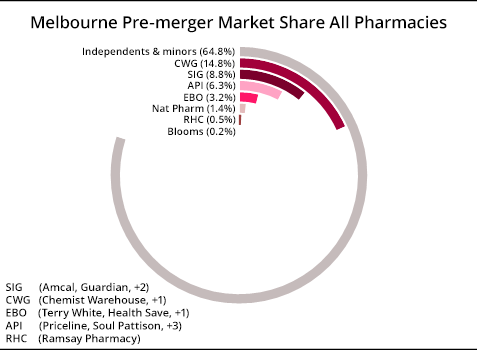

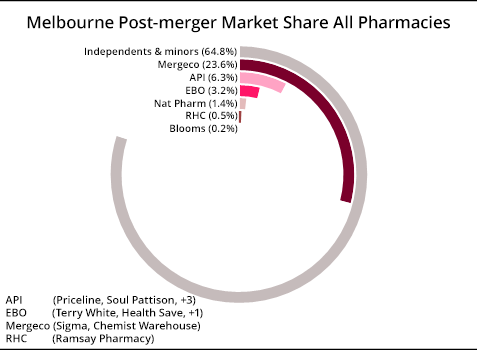

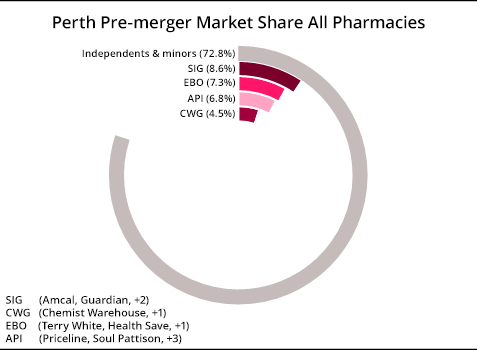

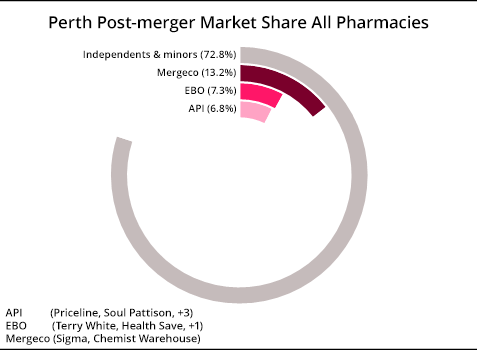

Cycle through the two sets of tabs below to view pre and post merger market share data for all of Australia, for Australian metro areas, and for each major metro area individually.

- The top tabs changes the data set between major banner brand operators only, and all pharmacies.

- The bottom tabs toggle between metro areas, Australia as a whole, and aggregate Australian metro areas.

- The chart on the left shows the market share pre-merger, and the chart on the right post-merger.

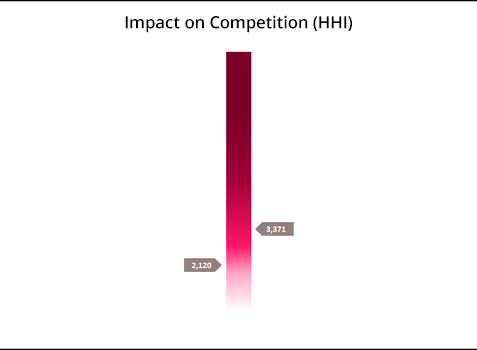

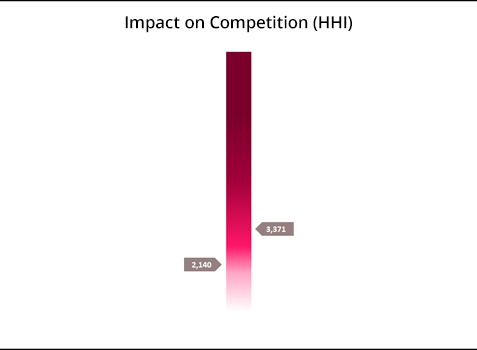

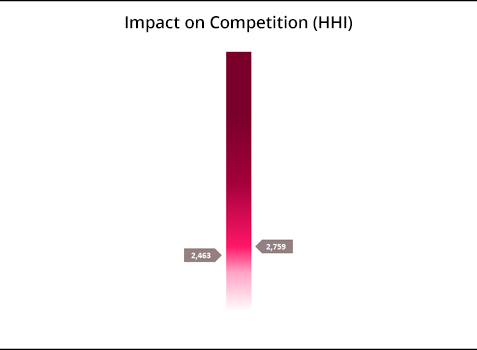

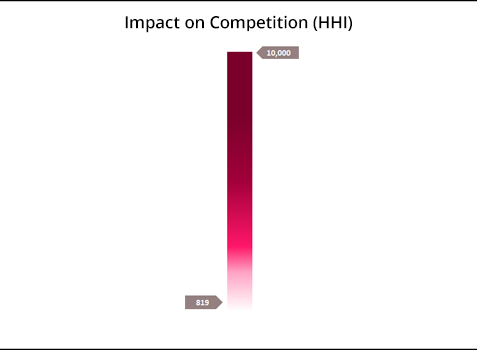

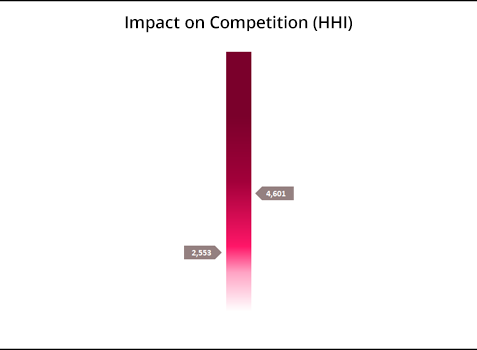

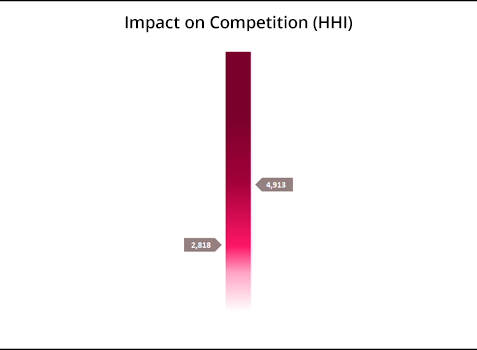

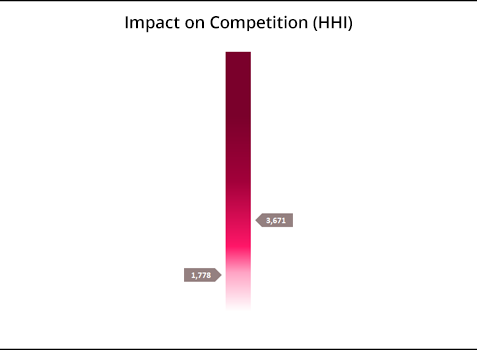

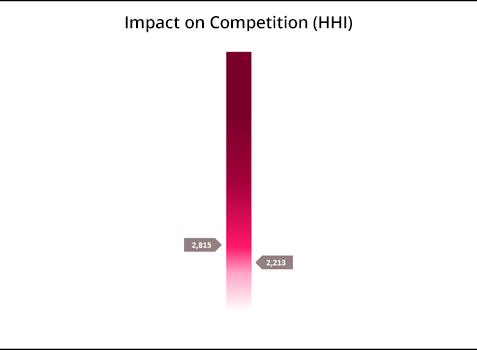

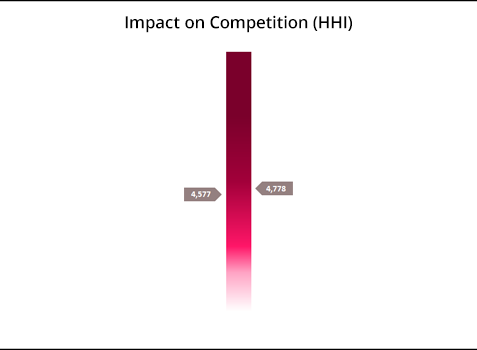

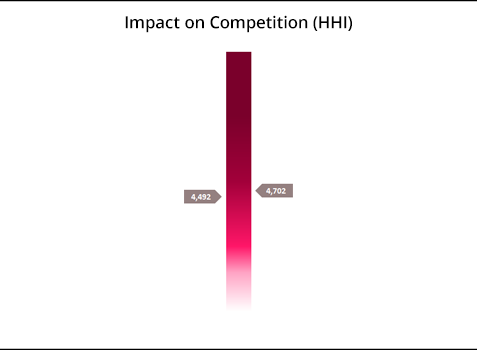

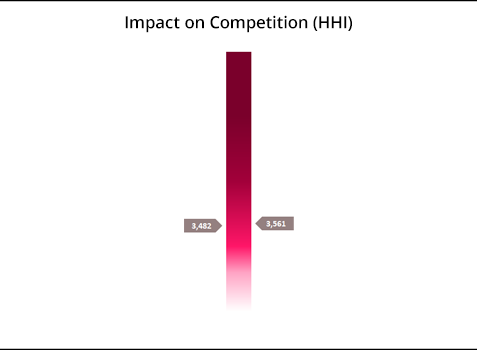

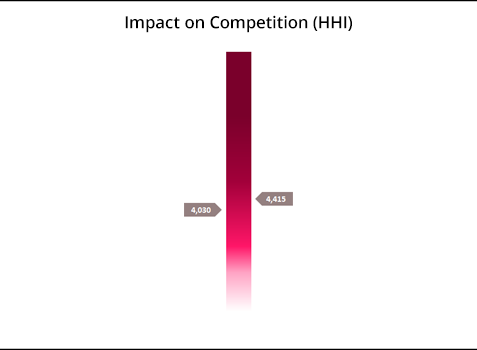

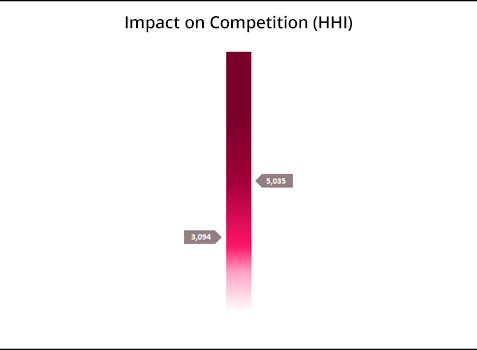

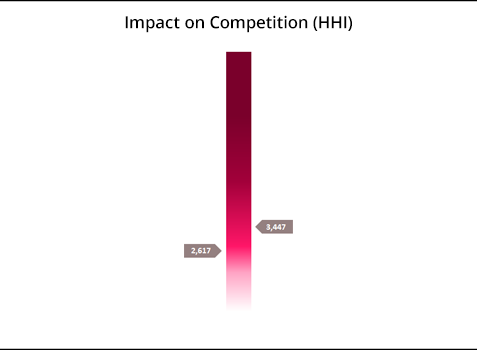

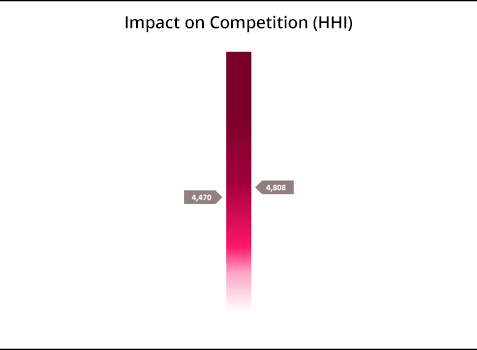

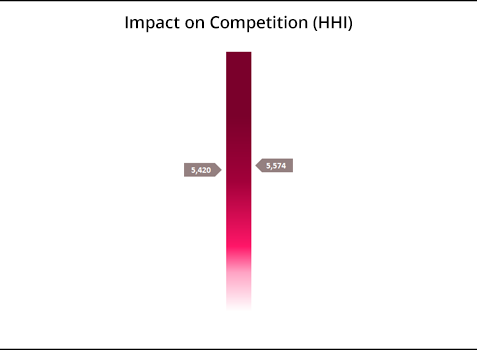

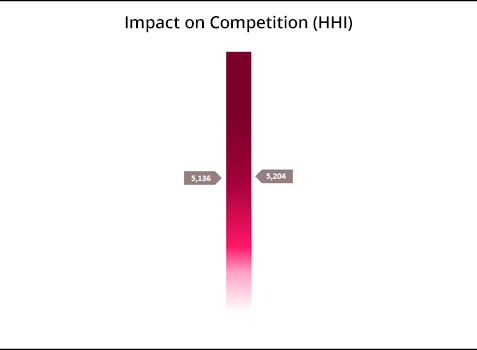

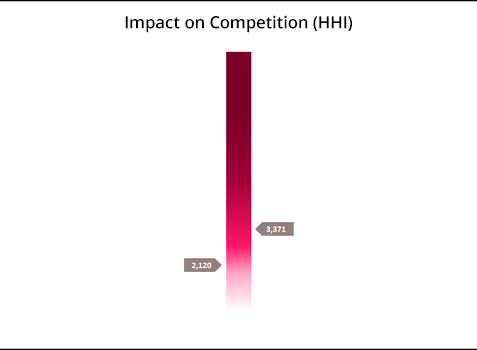

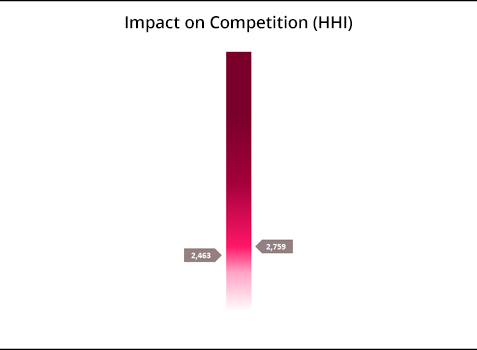

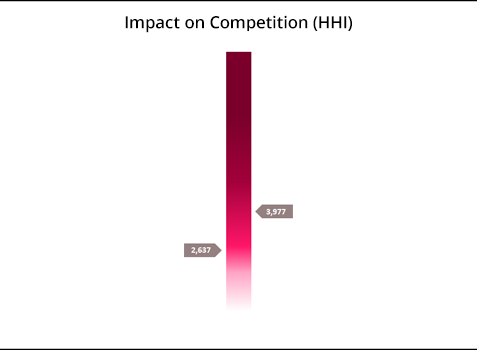

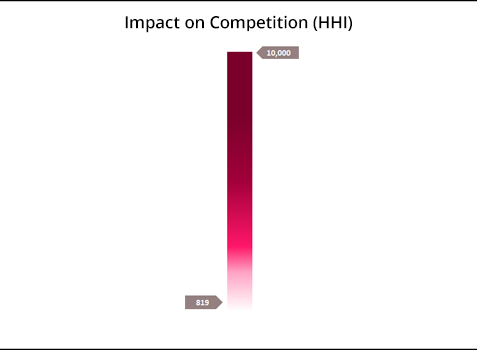

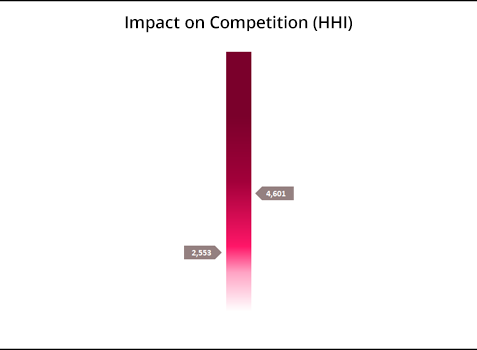

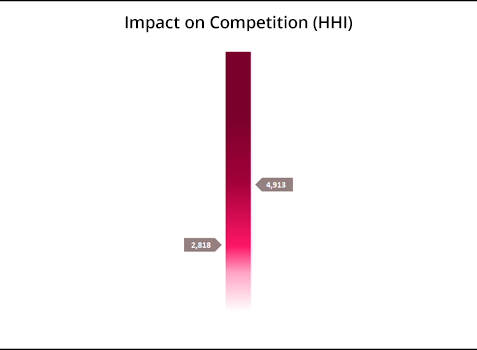

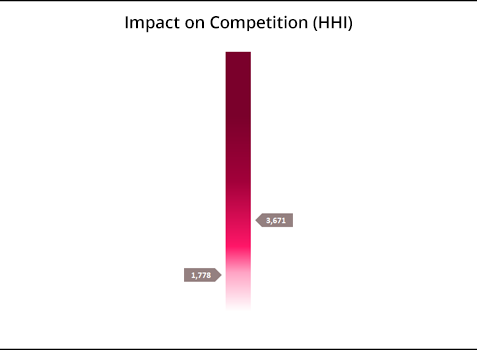

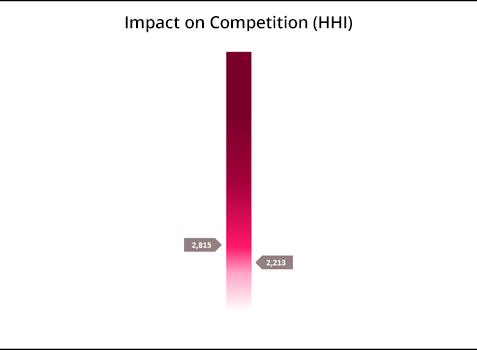

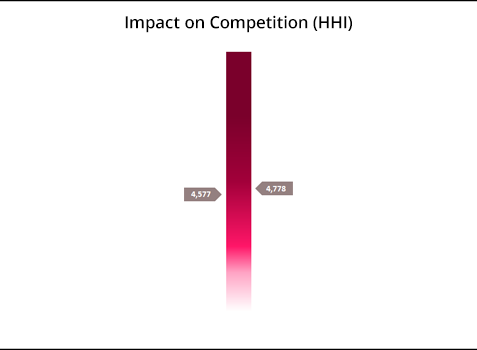

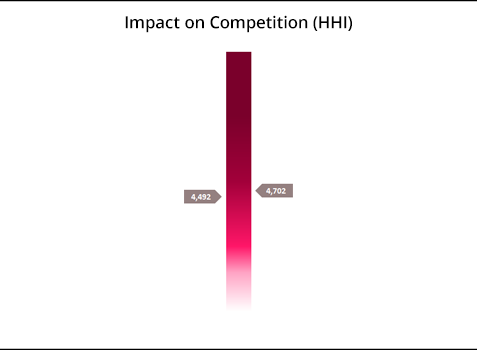

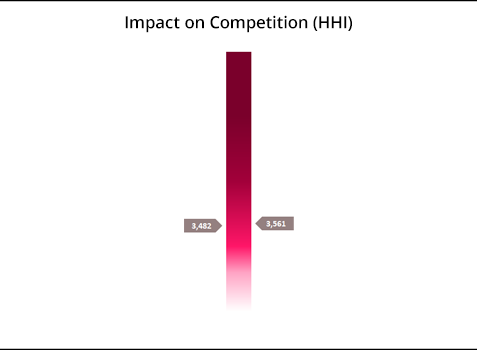

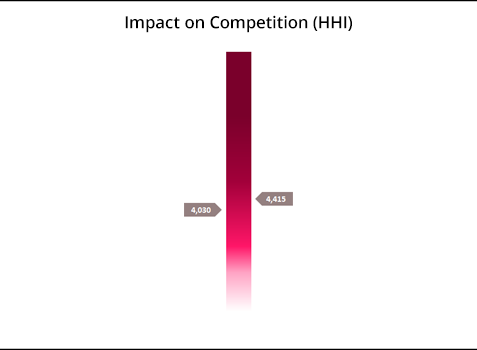

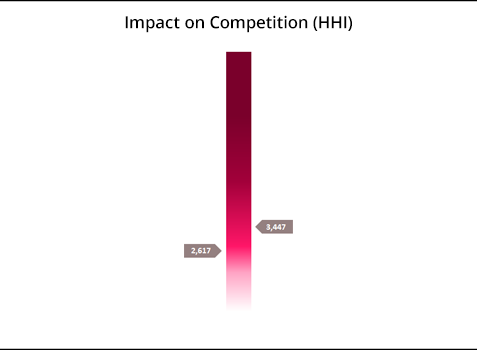

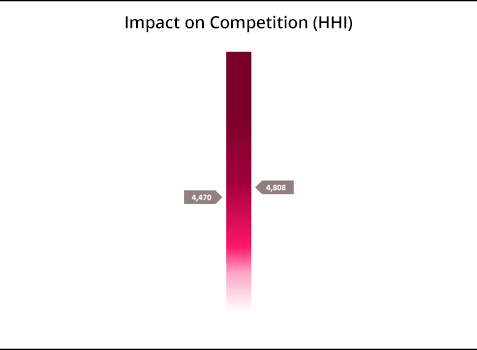

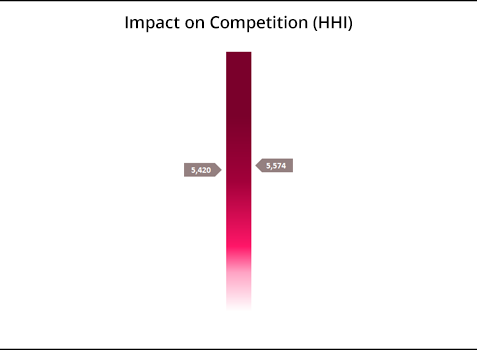

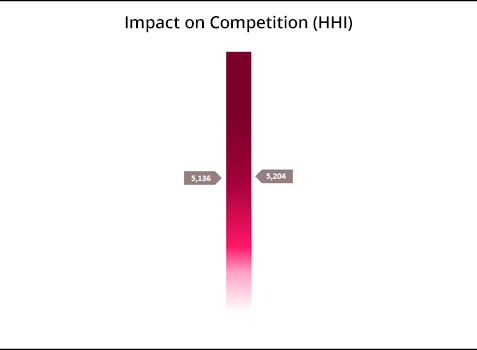

- The chart in the middle shows the impact on competition using an approximated Herfindahl-Hisrchman Index based on store count.

- Unconcentrated markets have a HHI below 1,500

- Moderately concentrated markets have a HHI between 1,500 and 2,500

- Highly concentrated markets have a HHI above 2,500

Majors Only

Australia

Australia Metro

Adelaide

Brisbane

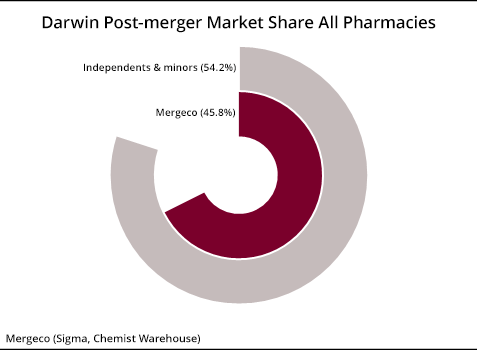

Darwin

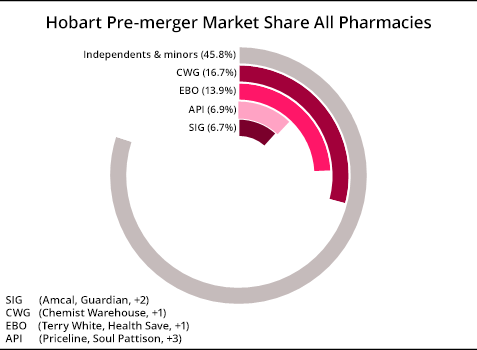

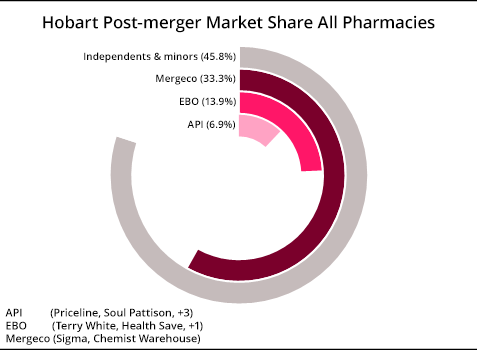

Hobart

Melbourne

Perth

Sydney

All Pharmacies

Australia

Australia Metro

Adelaide

Brisbane

Darwin

Hobart

Melbourne

Perth

Sydney

The Herfindahl-Hirschmann Index (HHI)

From ACCC's "Merger Guidelines"

- “The ACCC will consider the impact of the merger on competition, including whether it will lead to a substantial lessening of competition in any market.”

- “The ACCC focuses on both the potential for unilateral effects, where the merged firm could exercise market power, and coordinated effects, where the merger could facilitate coordinated behaviour among remaining firms.”

From ACCC's "Merger Guidelines"

“Australia has many markets that are highly concentrated, which is perhaps not surprising given the relative size of our population. Supermarkets and liquor are often identified as two such markets.”

“The ACCC’s focus will in many cases be limited to analysing the impact of an acquisition on a local retail market, given that the acquisition of one store is most unlikely to substantially lessen competition at a national, state, or regional level.”

The Herfindahl-Hirschmann Index (HHI)

How HHI works

Why ACCC uses HHI

Sensitivity to Market Share Distribution:

The ACCC uses HHI because it reflects the size and distribution of firms, allowing for a more nuanced understanding of market structure compared to simpler measures like market share alone.

“The HHI is more sensitive to changes in the size distribution of firms within an industry, which provides a more comprehensive measure of market concentration.”

Regulatory Framework:

The ACCC’s approach aligns with global standards for competition analysis, ensuring consistency and reliability in its assessments.

“We review mergers to determine whether they are likely to substantially lessen competition in breach of the law.”

Preventing Anti-Competitive Mergers:

Using HHI helps the ACCC identify mergers that could lead to anti-competitive outcomes, such as higher prices, lower quality, and reduced innovation.

“Mergers can substantially lessen competition by reducing the number of competitors in a market and changing the way the remaining competitors behave.” (ACCC, Mergers)

Sources

Australian Competition & Consumer Commission:

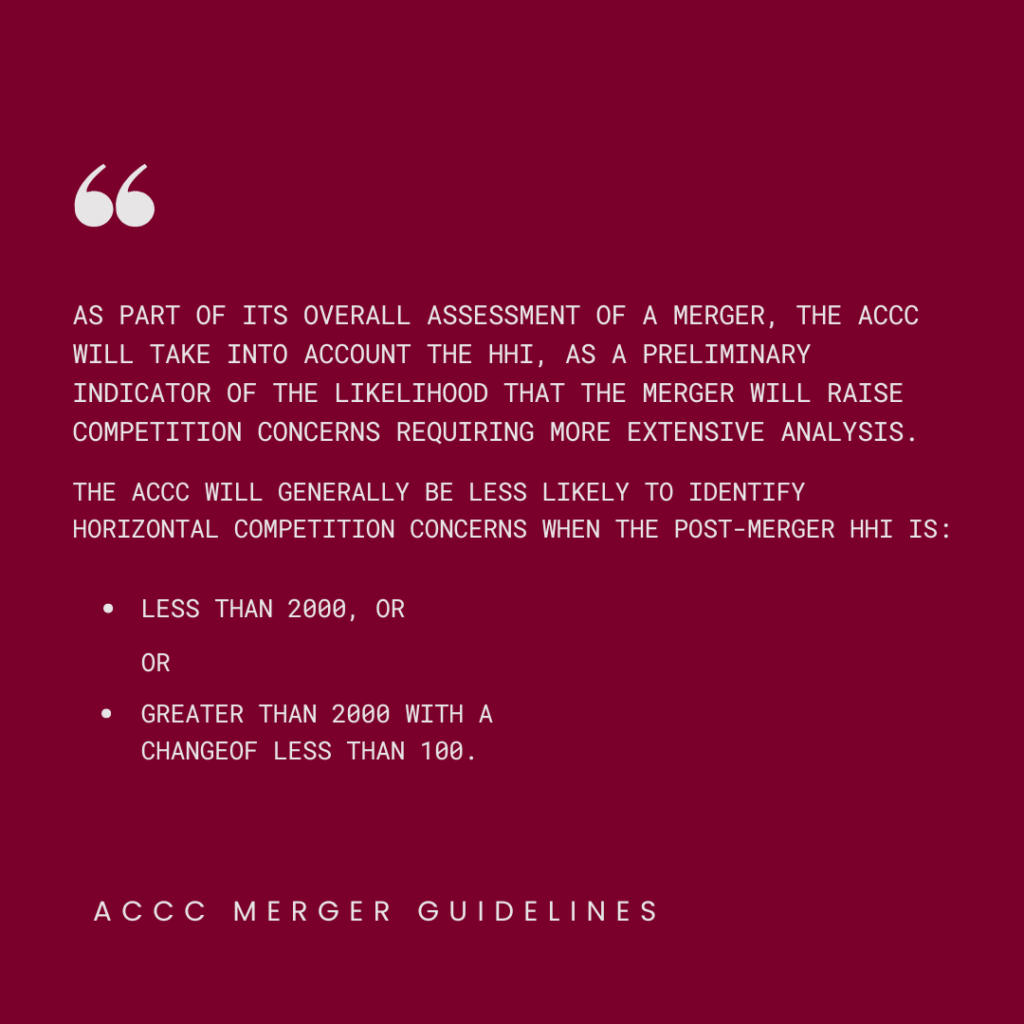

"As part of its overall assessment of a merger, the ACCC will take into account the HHI, as a preliminary indicator of the likelihood that the merger will raise competition concerns requiring more extensive analysis. The ACCC will generally be less likely to identify horizontal competition concerns when the post-merger HHI is: - less than 2000, or - greater than 2000 with a delta less than 100."

ACCC Merger Guidelines

In the ACCC’s December 2023 inquiry into the national electricity market they defined the following:

- Unconcentrated markets have a HHI below 1,500

- Moderately concentrated markets have a HHI between 1,500 and 2,500

- Highly concentrated markets have a HHI above 2,500

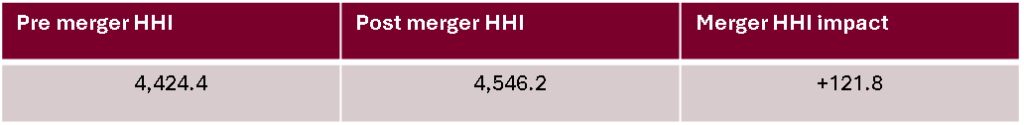

Approximated HHI for all pharmacies

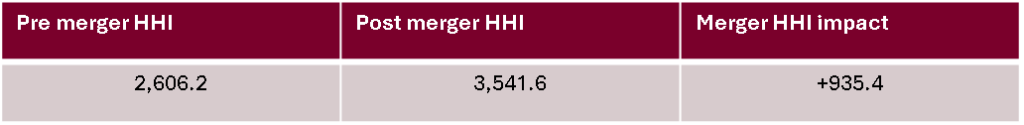

Approximated HHI for the Major Banner market segment

Presented with the analysis above, can the ACCC truly be satisfied that the merger of two of Australia’s largest community pharmacy operators is unlikely to substantially lessen competition or likely to result in a net public benefit?

This transaction simply does not pass the pub test.